Manila Times

Upholding Truth. Empowering the Philippines

Wednesday, Jul 30, 2025

The Nation's Story is Told with Honor

Philippine Stock Exchange Index Sees Modest Rise Amid Geopolitical Tensions

The PSEi closes at 6,395.59, influenced by US economic data and regional unrest.

The Philippine Stock Exchange Index (PSEi) registered a gain in its latest trading session, propelled by positive economic data from the United States and anticipations of a potential interest rate cut by the Bangko Sentral ng Pilipinas (BSP) next week.

The index increased by 14.27 points, or 0.22 percent, finishing the day at 6,395.59.

Market activity was marked by a total volume of 1.16 billion shares, amounting to ₱9.86 billion in transactions.

Advancing stocks outnumbered declining ones, with 108 gaining and 92 losing, while 47 remained unchanged.

Notably, the mining sector experienced a significant uptick, contrasting with a decline in the conglomerate and services sectors.

A substantial influence on investor sentiment stemmed from fresh US economic indicators.

The May producer price index increased by a marginal 0.1 percent, a figure that was lower than analysts' expectations, suggesting a potential easing in inflationary pressures within the US economy.

Luis Limlingan, managing director at Regina Capital Development Corp., noted the key role of this data in shaping market movements.

Additionally, he pointed out that uncertainties surrounding trade relations were impacting sentiment following statements from US President Donald Trump regarding the potential extension of a tariff deadline originally set for July 8. Any developments in US-China negotiations continue to capture market attention.

Furthermore, Japhet Tantiangco, a research manager at Philstocks Financial, indicated that expectations surrounding a possible policy rate cut by the BSP were also contributing to the upward trend in the local market.

However, Tantiangco cautioned that the gains were moderated due to rising geopolitical tensions, particularly following Israeli airstrikes targeting locations in Iran, which have heightened fears about regional instability.

The index increased by 14.27 points, or 0.22 percent, finishing the day at 6,395.59.

Market activity was marked by a total volume of 1.16 billion shares, amounting to ₱9.86 billion in transactions.

Advancing stocks outnumbered declining ones, with 108 gaining and 92 losing, while 47 remained unchanged.

Notably, the mining sector experienced a significant uptick, contrasting with a decline in the conglomerate and services sectors.

A substantial influence on investor sentiment stemmed from fresh US economic indicators.

The May producer price index increased by a marginal 0.1 percent, a figure that was lower than analysts' expectations, suggesting a potential easing in inflationary pressures within the US economy.

Luis Limlingan, managing director at Regina Capital Development Corp., noted the key role of this data in shaping market movements.

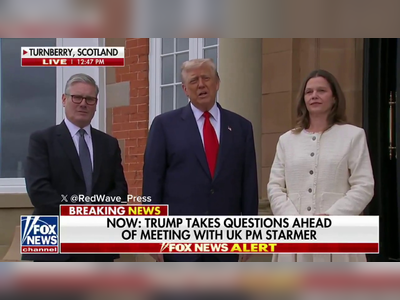

Additionally, he pointed out that uncertainties surrounding trade relations were impacting sentiment following statements from US President Donald Trump regarding the potential extension of a tariff deadline originally set for July 8. Any developments in US-China negotiations continue to capture market attention.

Furthermore, Japhet Tantiangco, a research manager at Philstocks Financial, indicated that expectations surrounding a possible policy rate cut by the BSP were also contributing to the upward trend in the local market.

However, Tantiangco cautioned that the gains were moderated due to rising geopolitical tensions, particularly following Israeli airstrikes targeting locations in Iran, which have heightened fears about regional instability.

AI Disclaimer: An advanced artificial intelligence (AI) system generated the content of this page on its own. This innovative technology conducts extensive research from a variety of reliable sources, performs rigorous fact-checking and verification, cleans up and balances biased or manipulated content, and presents a minimal factual summary that is just enough yet essential for you to function as an informed and educated citizen. Please keep in mind, however, that this system is an evolving technology, and as a result, the article may contain accidental inaccuracies or errors. We urge you to help us improve our site by reporting any inaccuracies you find using the "Contact Us" link at the bottom of this page. Your helpful feedback helps us improve our system and deliver more precise content. When you find an article of interest here, please look for the full and extensive coverage of this topic in traditional news sources, as they are written by professional journalists that we try to support, not replace. We appreciate your understanding and assistance.